Field notes: May (and a bit of April)

On climate, running, and reading

Another month gone by in a flash! The pace of change, especially in policy, technology, and (un)natural disasters, makes grounding activities and long-term values ever important. To me, the climate, running, and reading are such things - and sharing that journey with loved ones. In that vein, I’m sharing some images and reflections that caught my mind this month.

On Climate

J.P. Morgan’s Climate Intuition

An excellent series on decision-making in the non-linear climate paradigm, by Dr. Sarah Kapnick, Global Head of Climate Advisory at J.P. Morgan and former Chief Scientist at NOAA. A few insights stood out from the publications so far:

1. Navigating the new climate era

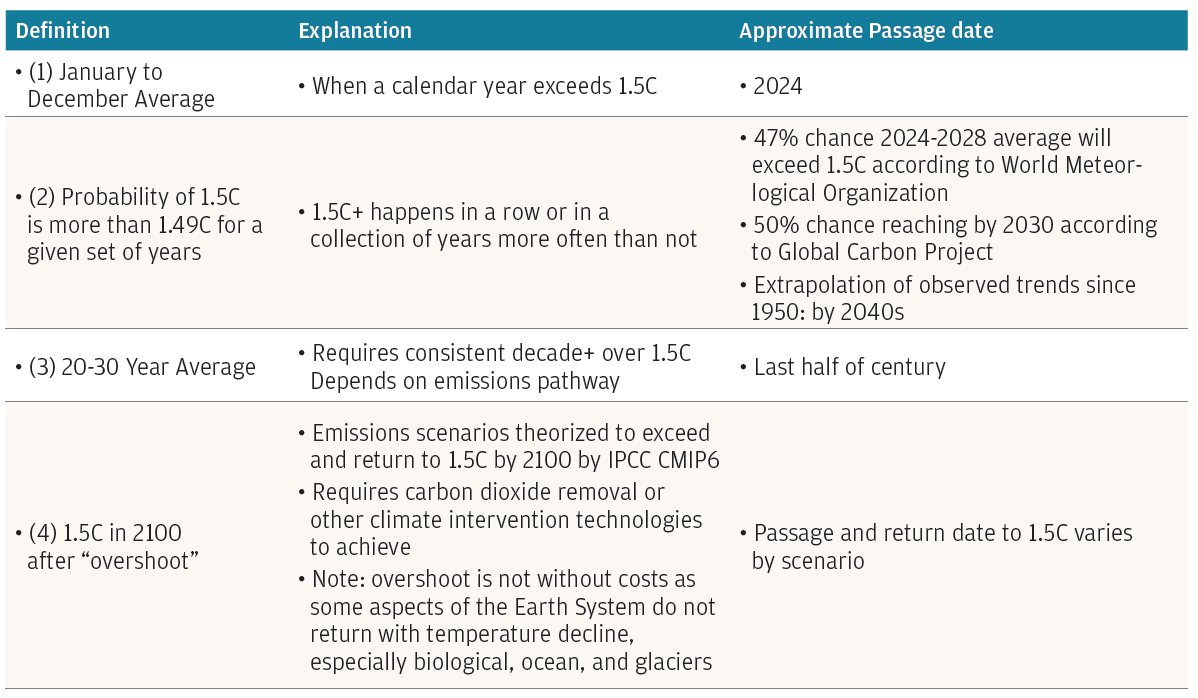

We’ve passed, or are close to passing, 1-2 milestones towards the 1.5°C threshhold. threshhold. More extreme events can happen faster, disrupting static thinking based on past experience.

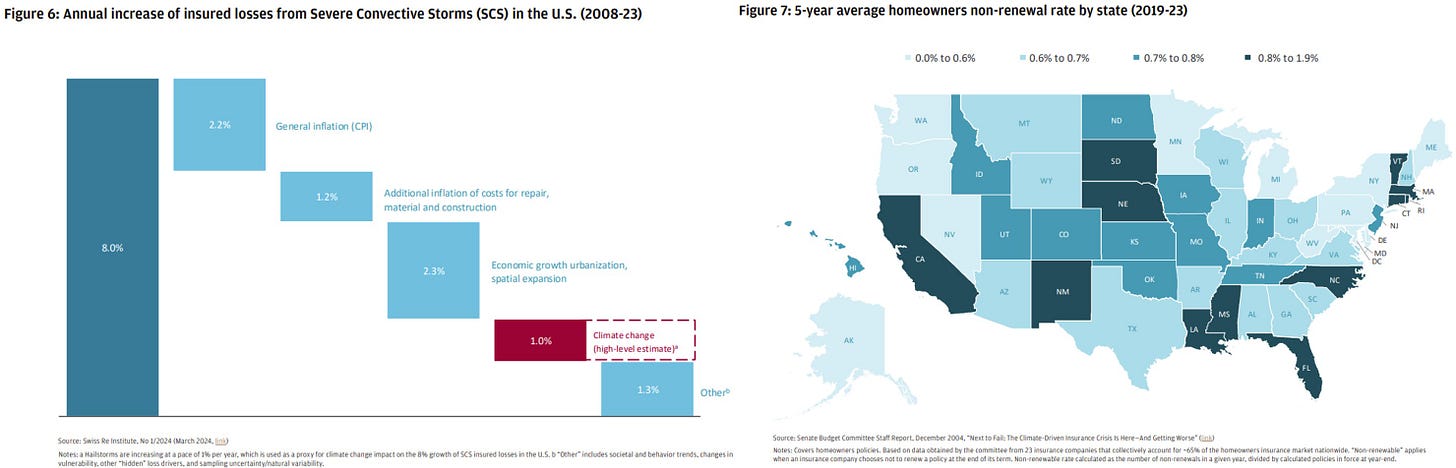

2. The future of homeowners insurance

There are no silver bullets to the affordability crisis in homeowners insurance. States are stuck between premium pricing restrictions, private sector pullback, and declining property values. New building codes tend to come after disasters, even when the risks are well known. Policy will be essential to continue adopting new codes and to help address rising costs from construction and material inflation, but change is slow. Insurance can evolve by pooling differentiated risks, such as through catastrophe bonds, and by leveraging financial innovations like parametric or index-based and excess & surplus insurance, and incentives for resilient infrastructure.

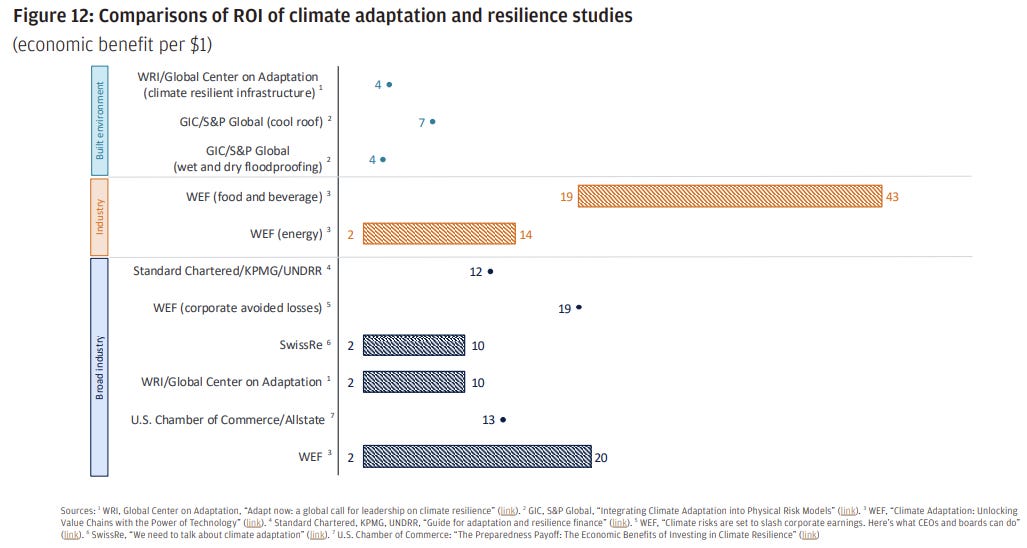

3. Unlocking resilience through strategic climate adaptation

Climate adaptation, often framed as a risk management decision, is increasingly recognized as a strategic advantage to build resilience. Companies have taken different approaches, from early movers, cautious amortization, to the status-quo wait-and-see. The latter could lead to $1.2 trillion in annual losses for large corporates by the 2050s. But the narrative is shifting towards an upside opportunity. Markets are starting to reward it, and analysis shows returns from $2-43 per $1 invested in adaptation and resilience.

Japan’s role in leading climate action

Energy transition

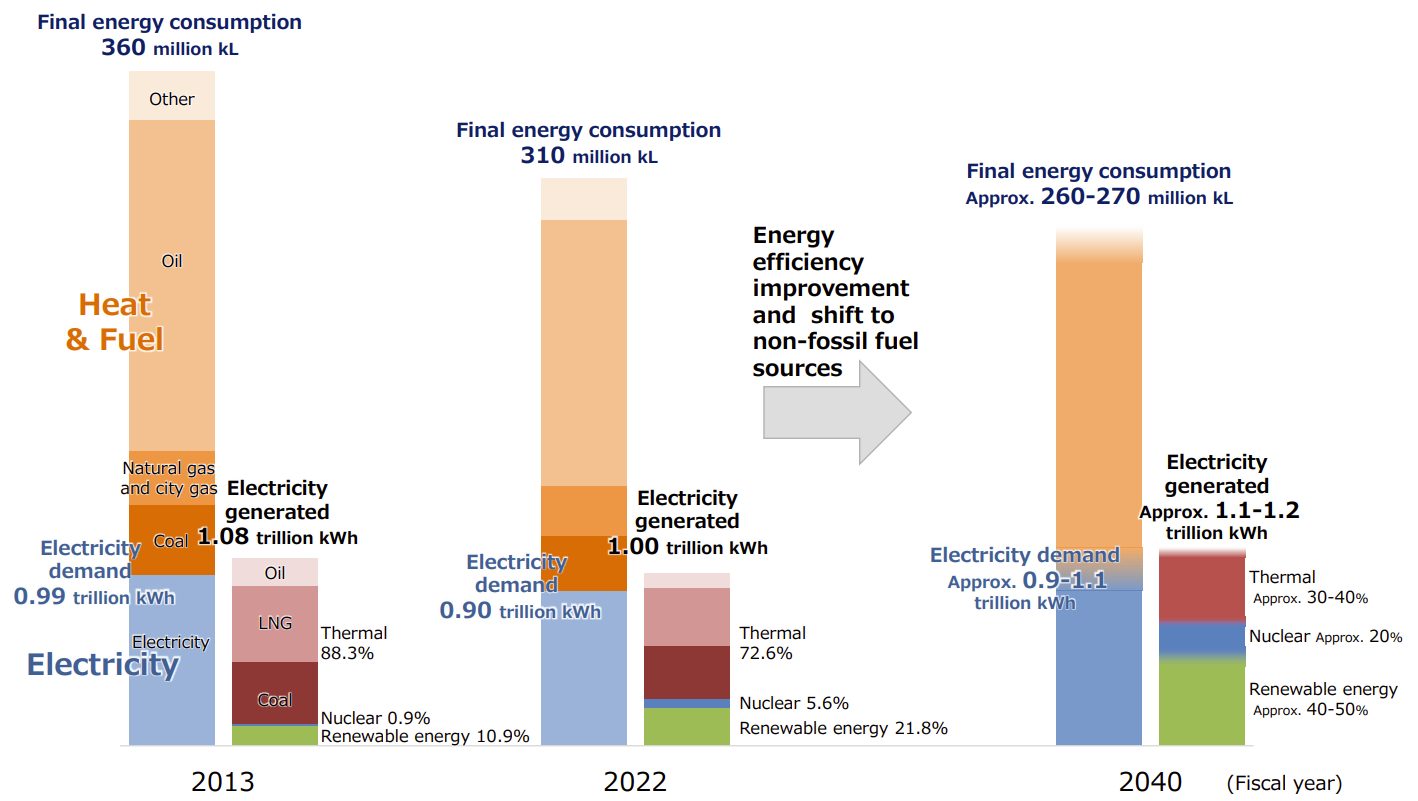

Much of Japan’s latest Strategic Energy Plan for 2040 outlines an “all-of-the-above” approach to energy supply and demand, similar to strategies seen in the U.S. and elsewhere. The plan prioritizes securing a stable energy supply with a “balanced power generation mix” in response to rising electricity demand, driven by the expansion of data centers and semiconductor facilities. A few renewable energy technologies that seemed more distinctive to the Japanese context got a call out, including perovskite solar cells, floating offshore wind, next-generation geothermal, and small to medium-sized hydropower.

Carbon Markets & Trading

Japan’s carbon market strategy and GX (Green Transformation) initiatives have developed gradually over the past 3 years:

The GX-League, launched in April 2022, brings together more than 550 companies that are collectively responsible for over 50% of Japan’s greenhouse gas emissions and expected to voluntarily develop emissions reductions targets in alignment with national climate goals

The GX-ETS, launched in April 2023, is a voluntary carbon trading scheme that allows companies to trade emissions allowances and becomes compliance-based in 2026.

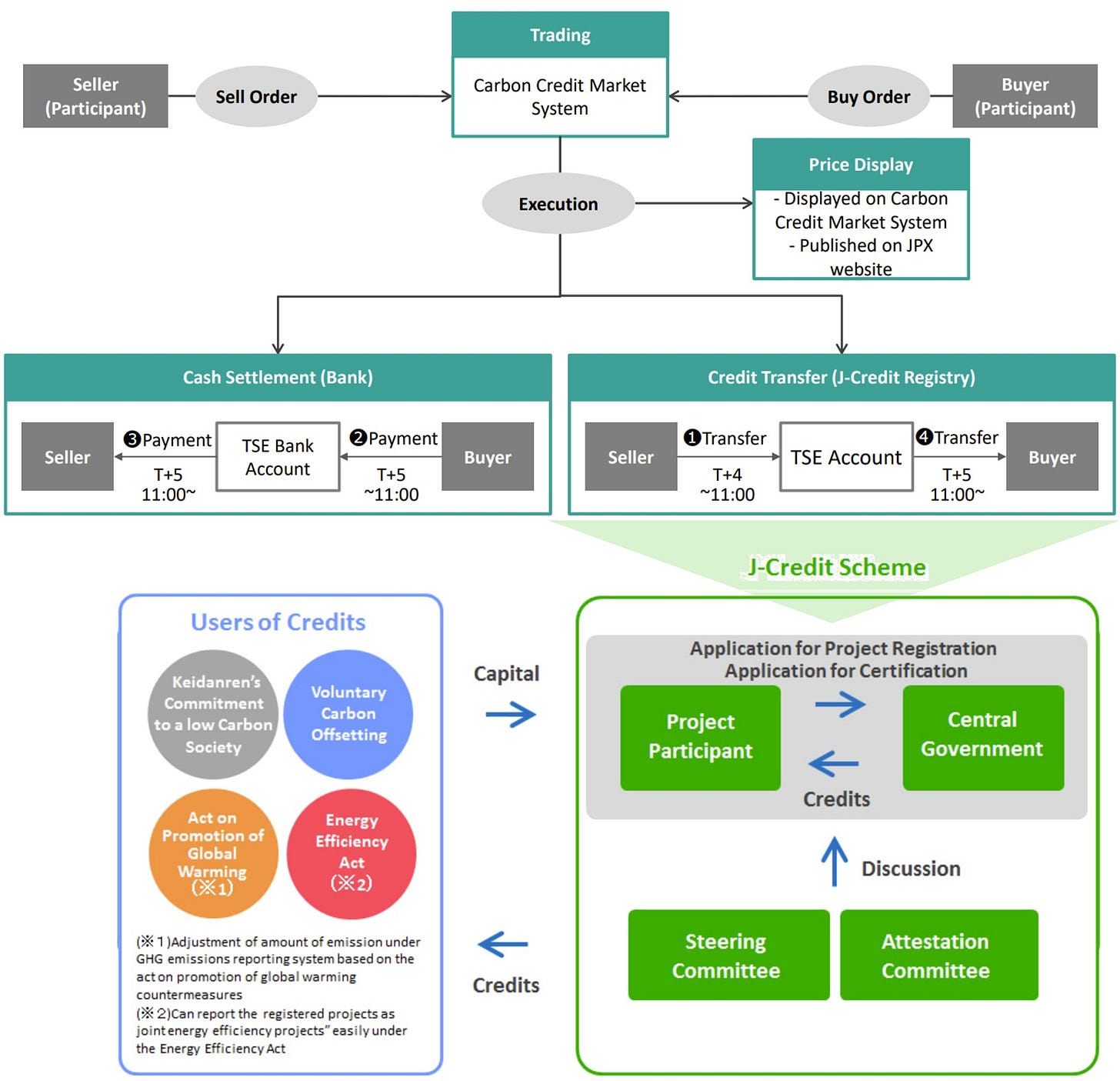

In Oct 2023, the Tokyo Stock Exchange opened its carbon credit trading market where companies can buy and sell “J-Credits,” which are certified by the Japanese government. These currently don’t include engineered carbon removal.

In April 2025, the Tokyo Metropolitan Government rolled out a new blockchain-backed platform, the Tokyo Carbon Credit Market, to complement Tokyo’s mandatory cap-and-trade scheme.

There are still significant gaps to clarify, including eligibility criteria for projects and “Japanese content,” harmonization of J-Credits and GX-ETS, and setting emissions caps. However, momentum is expected to continue as the Japanese government has pledged USD $1TN over 10 years to support the GX-League and a wide range of projects including carbon dioxide removal in Japan and internationally.

On Running

Avenue of the Giants

Back at my desk and four walls, I hang onto the feeling of being immersed among graceful giants, quietness deep enough to hear creaking branches, the sun peeking through at shifting angles, the ground speckled by delicate flowers in mossy fauna, roots with cross-sections taller than me, and a felled tree that took seconds to run its full length.

Vancouver

I’ve been to Vancouver many times - celebrating a sibling’s graduation, running one of my favorite marathons, supporting a company building the carbon capture industry - but the paths around Deer Lake were a new find.

On Reading

War, by Bob Woodward

A gripping view into foreign relations, negotiation, and American politics that I audio-read over two flights. It’s wild how close the world has come to the brink of WWIII, often driven by irrational, almost emotional posturing of leaders. The insight gave me a deeper appreciation for the complexity and technological sophistication of the defense world, and made life as I currently know it feel both more inconsequential and more existential.

Meditations for Mortals, by Oliver Burkeman

Burkeman reframes concepts and old wisdom in an accessible and resonant way, echoing themes from Four Thousand Weeks, but in a format that works well as a daily listen on a commute or with coffee. Embracing the fact that we’re inherently limited can free us to act on what truly matters and let go of perfectionism. To-dos become a menu of options rather than a daily debt to repay, and we can always take steps, however small or imperfect, toward becoming the person we want to be.

Interesting to read about the private sector view on climate adaptation & insurance! I haven't heard about catastrophe bonds before - will read into it, thanks.